This features understanding IRS regulations, running investments, and averting prohibited transactions that may disqualify your IRA. An absence of data could lead to high-priced errors.

Constrained Liquidity: Most of the alternative assets which can be held in an SDIRA, like property, private equity, or precious metals, might not be easily liquidated. This may be a concern if you'll want to entry funds quickly.

Even though there are numerous Advantages associated with an SDIRA, it’s not devoid of its very own negatives. Several of the typical explanation why buyers don’t pick SDIRAs include:

IRAs held at financial institutions and brokerage firms offer you minimal investment choices for their purchasers given that they don't have the abilities or infrastructure to administer alternative assets.

Increased Service fees: SDIRAs normally come with better administrative charges in comparison to other IRAs, as selected aspects of the administrative procedure can not be automatic.

Put simply just, in the event you’re seeking a tax effective way to develop a portfolio that’s far more personalized towards your interests and knowledge, an SDIRA can be The solution.

Variety of Investment Possibilities: Ensure the service provider lets the categories of alternative investments you’re thinking about, such as real estate property, precious metals, or private fairness.

Consider your Close friend may be starting up the subsequent Fb or Uber? Having an SDIRA, you'll be able to invest in triggers that you believe in; and likely delight in bigger returns.

And because some SDIRAs for instance self-directed traditional IRAs are subject matter to essential bare minimum distributions (RMDs), you’ll must plan in advance to ensure that you've got ample liquidity to fulfill The principles set via the IRS.

The tax pros are what make SDIRAs beautiful For several. An SDIRA may be both of those classic or Roth - the account type you decide on will depend mostly in your investment and tax technique. Check with your money advisor or tax advisor for those who’re Not sure which can be very best for yourself.

As soon as you’ve found an SDIRA company and opened your account, you may well be asking yourself how to really start investing. Comprehension both the rules that govern SDIRAs, as well as the way to fund your account, may also help to lay the foundation for any future of prosperous investing.

Yes, real estate is among our clientele’ most favored investments, from time to time named a real estate property IRA. Shoppers have the choice to speculate in all the things from rental properties, professional real estate property, undeveloped land, mortgage notes and much more.

Have the liberty to speculate in Nearly any type of asset by using a hazard profile that matches your investment strategy; such as assets that have the prospective for a better amount of return.

The leading SDIRA rules through the IRS that traders need to comprehend are investment constraints, disqualified people, and prohibited transactions. Account holders will have to abide by SDIRA guidelines and rules so as to maintain the tax-advantaged position in their account.

Entrust can help you in acquiring alternative investments along with your retirement funds, and administer the buying and selling of assets that are generally unavailable by way of banking institutions and brokerage firms.

An SDIRA custodian differs as they have the appropriate workers, knowledge, and capacity to keep up custody in the alternative Visit Website investments. The first step in opening a self-directed IRA is to locate a provider that may be specialized in administering accounts for alternative investments.

Homework: It can be referred to as "self-directed" for a explanation. With an SDIRA, that you are completely chargeable for thoroughly investigating and vetting investments.

A self-directed IRA is surely an incredibly strong investment vehicle, nonetheless it’s not for Homepage everybody. As the stating goes: with good power comes excellent accountability; and by having an SDIRA, that couldn’t be extra accurate. Keep reading to find out why an SDIRA may possibly, or may not, be to suit your needs.

Transferring funds from one style of account to another variety of account, for example shifting cash from a 401(k) to a standard IRA.

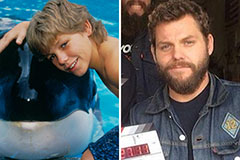

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now!